Investors are always on the lookout for stocks that offer both growth potential and steady income. One question that often arises is whether United Airlines is a dividend stock. While the airline industry has historically been known for its volatility, United Airlines has taken steps to strengthen its financial position and reward shareholders. In this article, we’ll explore whether United Airlines is a viable option for investors seeking dividend income.

Is United Airlines a Dividend Stock?

United Airlines is one of the largest airlines in the world, with a market capitalization of over $16 billion. The company has a strong financial position and is known for its operational efficiency. However, investors may wonder whether United Airlines is a good dividend stock. In this article, we will explore this question in detail.

Overview of United Airlines

United Airlines is a major American airline that operates flights to both domestic and international destinations. The company is headquartered in Chicago, Illinois, and has a fleet of over 800 aircraft. United Airlines is part of the Star Alliance, which is the world’s largest airline alliance. The company has a strong brand and is known for its customer service.

United Airlines has a strong financial position, with a net income of $2.3 billion in 2019. The company has a debt-to-equity ratio of 1.48, which is lower than the industry average. United Airlines also has a healthy cash reserve of $8.4 billion.

Despite its strong financial position, United Airlines does not currently pay a dividend. The company has not paid a dividend since 2014. United Airlines has stated that it prioritizes reinvesting in its business and paying down debt over paying dividends to shareholders.

Benefits of Dividend Stocks

Dividend stocks are popular among investors because they provide a regular source of income. Dividends are payments made by a company to its shareholders, usually on a quarterly basis. Dividend stocks are also seen as a more stable investment compared to growth stocks, which are more volatile.

Dividend stocks can also provide a hedge against inflation. As the cost of living increases, companies may increase their dividends to keep up with inflation. Additionally, dividend stocks can provide a sense of security to investors. Even if the stock price declines, investors can still receive a steady stream of income.

United Airlines vs Other Dividend Stocks

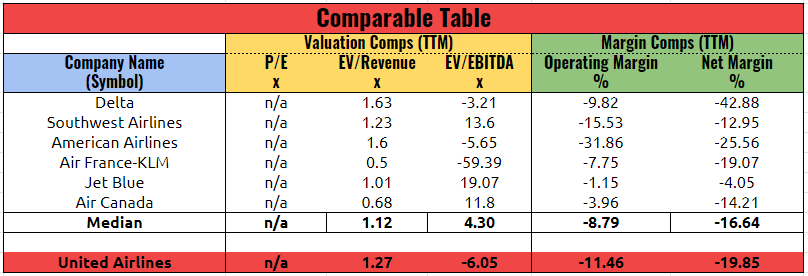

When comparing United Airlines to other dividend stocks, it is important to consider the company’s financial position and dividend history. Compared to other airlines, United Airlines has a strong financial position and a proven track record of operational efficiency. However, the company does not currently pay a dividend, which may be a disadvantage for investors looking for income.

When compared to other dividend-paying stocks in other industries, United Airlines may not be as attractive. Many other companies in industries such as utilities, consumer goods, and healthcare have a long history of paying dividends and have a higher dividend yield than United Airlines would have if it paid a dividend.

Conclusion

In conclusion, United Airlines is not currently a dividend stock. The company has a strong financial position and is known for its operational efficiency, but has prioritized reinvesting in its business and paying down debt over paying dividends. While dividend stocks can provide a regular source of income and a hedge against inflation, investors looking for income may want to consider other dividend-paying stocks in other industries.

It is important for investors to carefully consider their investment goals and risk tolerance before investing in any stock. While United Airlines may not be a dividend stock, it may still be a good investment opportunity for investors seeking growth and capital appreciation.

Contents

- Frequently Asked Questions

- What is a dividend stock?

- Does United Airlines pay dividends?

- What factors should I consider when investing in United Airlines?

- Is United Airlines a good investment?

- What are the risks of investing in United Airlines?

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Frequently Asked Questions

What is a dividend stock?

A dividend stock is a company that pays a portion of its earnings to shareholders in the form of dividends. These payments are typically made quarterly or annually and are usually a percentage of the company’s profits.

Dividend stocks are popular among investors who are looking for a steady stream of income from their investments, and they can be a good way to diversify a portfolio.

Does United Airlines pay dividends?

No, United Airlines does not currently pay dividends to shareholders. The company has not paid a dividend since 2001, and instead, it has focused on reinvesting profits back into the business to support growth and expansion.

While some investors may prefer dividend-paying stocks, United Airlines has other strengths that make it an attractive investment opportunity, such as its strong market position and growth potential.

What factors should I consider when investing in United Airlines?

When considering an investment in United Airlines, there are several factors to keep in mind. These include the company’s financial performance, market position, growth potential, and competitive landscape.

It’s also important to consider broader industry trends and macroeconomic factors that could impact the airline industry, such as fuel prices, regulatory changes, and global economic conditions.

Is United Airlines a good investment?

Whether or not United Airlines is a good investment depends on a variety of factors, including your investment goals, risk tolerance, and overall portfolio strategy.

That being said, United Airlines has several strengths that make it an attractive investment opportunity, including its strong market position, growth potential, and focus on innovation and customer experience.

What are the risks of investing in United Airlines?

As with any investment, there are risks associated with investing in United Airlines. Some of the main risks include volatility in the airline industry, economic downturns, fuel price fluctuations, and regulatory changes.

It’s important to carefully evaluate these risks and consider how they fit into your overall investment strategy before making any investment decisions.

In conclusion, while United Airlines may not be considered a traditional dividend stock, it does offer potential for investors seeking long-term growth. The airline industry has shown resilience in the face of challenges and United Airlines has a strong market position, making it a viable investment option.

While the COVID-19 pandemic has impacted the airline industry in recent years, United Airlines has taken steps to adapt and remain competitive. This includes expanding its route network and investing in new aircraft, which should position the company for growth in the coming years.

Ultimately, whether or not United Airlines is a good fit for your investment portfolio will depend on your individual financial goals and risk tolerance. However, for those willing to take a long-term approach, United Airlines could be a worthwhile investment opportunity with potential for growth.