Have you ever considered purchasing trip insurance for your American Airlines flights? With the unpredictable nature of travel, it’s a question worth pondering. While it may seem like an unnecessary expense, trip insurance can offer peace of mind and protection against unexpected events that could derail your plans. In this article, we’ll explore whether or not trip insurance is worth it for American Airlines customers.

Contents

- Is Trip Insurance Worth It American Airlines?

- Frequently Asked Questions

- What is Trip Insurance?

- Does American Airlines Offer Trip Insurance?

- What Does American Airlines Trip Insurance Cover?

- How Much Does American Airlines Trip Insurance Cost?

- Is American Airlines Trip Insurance Worth It?

- Travel Insurance Tips: 7 Things to Know Before You Buy

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Is Trip Insurance Worth It American Airlines?

If you’re planning a trip with American Airlines, you may be wondering if trip insurance is worth the investment. While not required, trip insurance can provide peace of mind and financial protection in case of unexpected events. In this article, we’ll explore the benefits of trip insurance for American Airlines and help you decide if it’s right for your next trip.

What is Trip Insurance?

Trip insurance, also known as travel insurance, is a type of insurance that covers unexpected events that can occur before or during your trip. These events can include trip cancellations, flight delays, lost or stolen luggage, medical emergencies, and more.

Benefits of Trip Insurance for American Airlines Passengers

There are several benefits of trip insurance for American Airlines passengers. Here are some of the most significant benefits:

1. Protection Against Trip Cancellations or Interruptions

If you need to cancel or interrupt your trip due to unforeseen circumstances, trip insurance can help cover the costs associated with the cancellation or interruption. This can include non-refundable airline tickets, hotel reservations, and more.

2. Coverage for Medical Emergencies

If you or a family member experiences a medical emergency while traveling, trip insurance can help cover the costs associated with medical treatment, hospital stays, and emergency medical transportation.

3. Reimbursement for Lost or Stolen Luggage

If your luggage is lost or stolen during your trip, trip insurance can help cover the costs associated with replacing your belongings, such as clothing, toiletries, and other essential items.

4. Protection Against Flight Delays or Cancellations

If your flight is delayed or canceled due to weather, mechanical issues, or other unforeseen circumstances, trip insurance can help cover the costs associated with additional accommodations, meals, and transportation.

Is Trip Insurance Worth the Cost?

The cost of trip insurance varies depending on several factors, including the length of your trip, the coverage you select, and your age. However, the cost of trip insurance is typically a small percentage of the total cost of your trip.

While it may be tempting to skip trip insurance to save money, it’s important to consider the potential costs of unexpected events. For example, if you need to cancel your trip due to a medical emergency, the cost of trip insurance may be significantly less than the cost of non-refundable airline tickets, hotel reservations, and other travel expenses.

Trip Insurance vs. Other Types of Insurance

While trip insurance can provide valuable protection for unexpected events during your trip, it’s important to note that it’s not a substitute for other types of insurance, such as health insurance or homeowner’s insurance.

If you have health insurance, it’s important to review your policy to see if it provides coverage for medical emergencies while traveling. Similarly, if you’re traveling with expensive belongings, such as electronics or jewelry, you may want to consider purchasing additional insurance to protect these items.

Conclusion

In conclusion, trip insurance can provide valuable protection and peace of mind for American Airlines passengers. While the cost of trip insurance may vary, it’s important to consider the potential costs of unexpected events when deciding if it’s worth the investment. Be sure to review your policy carefully to understand the coverage and exclusions, and consider purchasing additional insurance if necessary to protect your health and belongings during your travels.

Frequently Asked Questions

Here are some common questions about trip insurance when flying with American Airlines.

What is Trip Insurance?

Trip insurance is a type of insurance that can protect you financially if your trip is cancelled or interrupted for covered reasons, such as illness, injury, or severe weather. It can also provide emergency medical coverage, baggage protection, and other benefits depending on the policy you choose.

It’s important to carefully review the terms and conditions of any policy you’re considering to ensure it meets your needs and provides adequate coverage for your trip.

Does American Airlines Offer Trip Insurance?

Yes, American Airlines offers trip insurance through its partner, Allianz Global Assistance. The coverage options can vary depending on your travel plans and needs, but typically include trip cancellation/interruption, emergency medical coverage, baggage protection, and other benefits.

You can purchase trip insurance when booking your American Airlines flight online or by contacting the airline’s customer service department.

What Does American Airlines Trip Insurance Cover?

American Airlines trip insurance can cover a variety of unexpected events that can disrupt your travel plans, including trip cancellation or interruption, emergency medical coverage, baggage protection, and travel delay coverage. The specific coverage options can vary depending on the policy you choose and your travel plans.

It’s important to carefully review the terms and conditions of any policy you’re considering to ensure it meets your needs and provides adequate coverage for your trip.

How Much Does American Airlines Trip Insurance Cost?

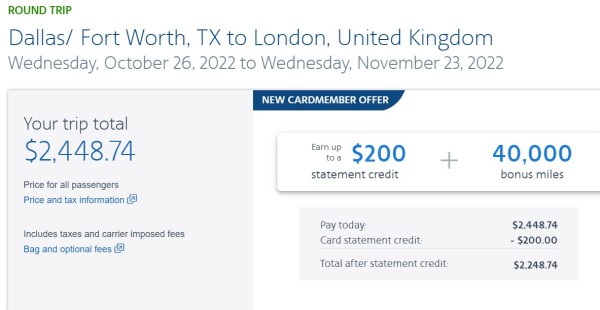

The cost of American Airlines trip insurance can vary depending on your travel plans and the coverage options you choose. The price can range from a few dollars to several hundred dollars, so it’s important to carefully review the policy and compare prices before making a decision.

Keep in mind that the cost of the insurance is typically a small percentage of the total cost of your trip, and can provide valuable protection in case of unexpected events that can disrupt your travel plans.

Is American Airlines Trip Insurance Worth It?

Whether American Airlines trip insurance is worth it depends on your individual travel plans and needs. If you have a non-refundable ticket or are traveling to a destination with a high risk of weather-related disruptions, trip insurance can provide valuable protection and peace of mind.

However, if you have a flexible travel schedule or are traveling to a low-risk destination, trip insurance may not be necessary. It’s important to carefully consider your travel plans and review the terms and conditions of any policy you’re considering to determine if it’s worth the cost.

Travel Insurance Tips: 7 Things to Know Before You Buy

In conclusion, trip insurance can be a valuable investment for travelers flying with American Airlines. The airline offers comprehensive coverage options that can protect travelers from unforeseen circumstances such as flight cancellations, delays, and medical emergencies.

While some may consider trip insurance an unnecessary expense, the peace of mind it provides can be priceless. With American Airlines’ trip insurance policies, travelers can rest assured that they are covered in the event of unexpected travel disruptions or emergencies.

Ultimately, the decision to purchase trip insurance is up to each individual traveler and their specific needs. However, for those looking for added protection and peace of mind while traveling with American Airlines, trip insurance may be worth the investment.