If you’re considering investing in United Airlines stock, you’re not alone. As the airline industry continues to recover from the pandemic, investors are eyeing the potential for growth and profitability. But is buying United Airlines stock a good move? Let’s explore the factors that could impact the stock’s performance and help you make an informed decision.

Contents

- Is It Good to Buy United Airlines Stock?

- Frequently Asked Questions

- What are the factors to consider before buying United Airlines stock?

- What are the potential benefits of buying United Airlines stock?

- What are the potential risks of buying United Airlines stock?

- What is the current state of United Airlines?

- Should I buy United Airlines stock?

- United is still the best airline stock going into 2023, says Cowen’s Helane Becker

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Is It Good to Buy United Airlines Stock?

Overview of United Airlines Stock

United Airlines is one of the largest airlines in the world, serving millions of passengers every year. The company’s stock is traded on the New York Stock Exchange under the ticker symbol UAL. The stock has had its ups and downs over the years, but recently it has been performing well. In this article, we will take a closer look at United Airlines stock and whether it is a good investment opportunity.

United Airlines stock has a market capitalization of approximately $16 billion, making it one of the largest airlines in the world by market value. The stock has been on an upward trend over the past few years, with a 52-week high of $97.85 and a low of $17.80. As of this writing, the stock is trading at around $55.00.

Benefits of Buying United Airlines Stock

There are several benefits to investing in United Airlines stock. Firstly, the company has a strong brand and a loyal customer base. This means that it is likely to continue to attract customers and generate revenue in the future. Additionally, United Airlines has been investing heavily in new technology and initiatives to improve its services, which could help to drive growth in the long term.

Another benefit of buying United Airlines stock is that it pays a dividend to its shareholders. This means that you can earn a steady stream of income from your investment, even if the stock price doesn’t increase significantly.

Risks of Buying United Airlines Stock

As with any investment, there are also risks associated with buying United Airlines stock. One of the main risks is the volatility of the airline industry. Airlines are heavily influenced by factors such as fuel prices, economic conditions, and geopolitical events, which can cause the stock price to fluctuate significantly.

Another risk of investing in United Airlines stock is the potential for negative publicity or safety concerns. Airlines are highly visible companies, and any negative news or safety incidents can have a significant impact on the stock price.

United Airlines Stock vs. Competitors

When considering whether to buy United Airlines stock, it is important to compare it to its competitors. The airline industry is highly competitive, with several large players vying for market share.

One of United Airlines’ main competitors is Delta Airlines. Delta has a similar market capitalization to United Airlines and has been performing well in recent years. However, United Airlines has a larger global network and is more diversified geographically, which could help to mitigate some of the risks associated with the airline industry.

Financial Performance of United Airlines

When evaluating a stock, it is important to look at the company’s financial performance. United Airlines has been performing well in recent years, with strong revenue growth and profitability.

In 2019, United Airlines reported revenue of $43.3 billion, up from $37.7 billion in 2018. The company also reported net income of $3 billion, up from $2.1 billion in 2018. These strong financial results suggest that United Airlines is well-positioned for future growth.

United Airlines Stock Price Analysis

When analyzing a stock, it is important to look at the stock price history. United Airlines’ stock price has been on an upward trend over the past few years, with a 52-week high of $97.85 and a low of $17.80. As of this writing, the stock is trading at around $55.00.

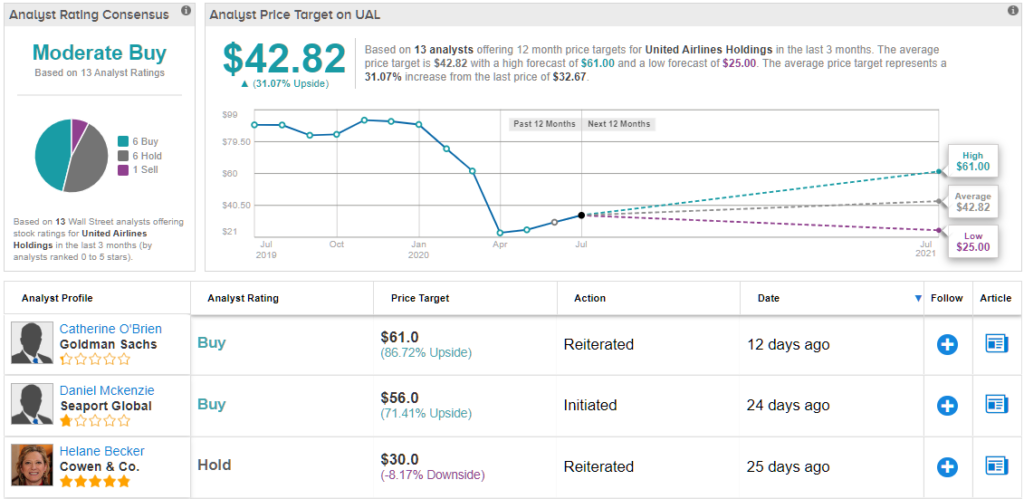

Analysts have a mixed view of United Airlines stock, with some recommending a buy and others recommending a hold. The company’s strong financial performance and brand recognition suggest that it could be a good investment opportunity, but the volatility of the airline industry should also be taken into account.

Should You Buy United Airlines Stock?

So, is it a good idea to buy United Airlines stock? The answer is that it depends on your investment goals and risk tolerance. United Airlines is a well-established company with a strong brand and a loyal customer base, which bodes well for its future growth. However, the airline industry is highly competitive and volatile, which means that there are risks associated with investing in United Airlines stock.

If you are looking for a long-term investment opportunity and are willing to take on some risk, United Airlines stock could be a good choice. However, if you are looking for a safer investment, you may want to consider other options.

Conclusion

In conclusion, United Airlines stock is an interesting investment opportunity for those looking to invest in the airline industry. The company has a strong brand and a loyal customer base, and has been performing well in recent years. However, the volatility of the airline industry should also be taken into account, and investors should carefully consider their risk tolerance before investing in United Airlines stock.

Frequently Asked Questions

What are the factors to consider before buying United Airlines stock?

Before buying United Airlines stock, it’s important to consider several factors. One of the most critical factors is the company’s financial health. Look at the company’s revenue, profitability, and debt levels to get a sense of its financial situation. Additionally, consider the broader economic environment and the state of the airline industry. Finally, think about your investment goals and risk tolerance to determine if United Airlines stock is a good fit for your portfolio.

What are the potential benefits of buying United Airlines stock?

There are several potential benefits to buying United Airlines stock. One of the main benefits is the potential for capital appreciation if the stock price increases over time. Additionally, United Airlines pays a dividend, so investors can receive regular income from the stock. Finally, owning shares of United Airlines allows investors to participate in the growth of the airline industry, which may be an attractive long-term investment opportunity.

What are the potential risks of buying United Airlines stock?

While there are potential benefits to buying United Airlines stock, there are also risks to consider. One of the main risks is the volatility of the airline industry, which can be affected by factors such as fuel prices, labor costs, and competition. Additionally, the COVID-19 pandemic has had a significant impact on the airline industry, and it may take some time for the industry to recover fully. Finally, there is no guarantee that United Airlines stock will perform well, and investors may lose money if the stock price declines.

What is the current state of United Airlines?

Like many airlines, United Airlines has been impacted by the COVID-19 pandemic. The company has had to reduce its flight schedules and implement cost-cutting measures to stay afloat. However, United has also taken steps to position itself for a recovery, such as securing additional financing and implementing new safety measures. As the vaccine rollout continues and travel demand increases, United Airlines may be poised for a rebound.

Should I buy United Airlines stock?

Deciding whether to buy United Airlines stock is a personal decision that depends on your investment goals and risk tolerance. If you believe in the long-term potential of the airline industry and are comfortable with the risks involved, United Airlines stock may be a good investment opportunity. However, it’s always important to do your own research and consult with a financial advisor before making any investment decisions.

United is still the best airline stock going into 2023, says Cowen’s Helane Becker

In conclusion, the decision to invest in United Airlines stock ultimately depends on individual circumstances and financial goals. While the airline industry has faced significant challenges in recent years, United Airlines’ strong financial performance and strategic initiatives may make it an attractive investment option for some.

However, it’s important to carefully consider the risks and benefits of investing in this industry, including factors such as market volatility and potential regulatory changes. It’s also crucial to conduct thorough research and seek advice from professional financial advisors before making any investment decisions.

In the end, investing in United Airlines stock can be a potentially lucrative opportunity for those willing to take on the associated risks. As with any investment, it’s important to approach it with caution and make informed decisions based on thorough research and analysis.