Have you ever considered purchasing flight insurance when booking your travel with American Airlines? With the unpredictability of travel, many individuals are left wondering if the added cost of flight insurance is worth the peace of mind it provides. Let’s explore the benefits and drawbacks of American Airlines’ flight insurance to help you make an informed decision.

Contents

- Is Flight Insurance Worth It American Airlines?

- Frequently Asked Questions

- What is flight insurance?

- What does American Airlines’ flight insurance cover?

- How much does American Airlines’ flight insurance cost?

- When should I consider purchasing flight insurance for American Airlines?

- Is American Airlines’ flight insurance worth it?

- Should you buy travel insurance for your plane ticket?

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Is Flight Insurance Worth It American Airlines?

If you’re planning a trip with American Airlines, you may be wondering if flight insurance is worth it. Flight insurance is an optional add-on that can provide extra protection in case of unexpected events, such as flight cancellations, delays, or medical emergencies. In this article, we’ll explore the benefits and drawbacks of buying flight insurance with American Airlines.

What is Flight Insurance with American Airlines?

Flight insurance is a type of travel insurance that covers unexpected events that may occur before or during your trip. American Airlines offers flight insurance through its partner, Allianz Global Assistance. This insurance can provide coverage for trip cancellation, trip interruption, travel delay, baggage delay, medical and dental emergencies, and more.

If you purchase flight insurance with American Airlines, you’ll be able to file a claim with Allianz Global Assistance in case of an emergency or unexpected event. The insurance policy will provide coverage according to the terms and conditions outlined in the policy.

Benefits of Flight Insurance with American Airlines

There are several benefits to purchasing flight insurance with American Airlines. Here are some of the key advantages:

1. Protection Against Unexpected Events: Flight insurance can provide coverage for unexpected events, such as flight cancellations, delays, or medical emergencies. This can give you peace of mind and help you avoid costly expenses.

2. Flexible Coverage: American Airlines offers different types of flight insurance, so you can choose the coverage that best fits your needs. For example, you can choose to purchase coverage for trip cancellation only, or you can opt for more comprehensive coverage that includes medical emergencies and other unexpected events.

3. Easy Claims Process: If you need to file a claim, the process is straightforward and easy to navigate. You can file a claim online or over the phone, and Allianz Global Assistance will guide you through the process.

Drawbacks of Flight Insurance with American Airlines

While there are many benefits to purchasing flight insurance with American Airlines, there are also some drawbacks to consider. Here are a few potential drawbacks:

1. Cost: Flight insurance can be expensive, and the cost can vary depending on the type of coverage you choose. You’ll need to weigh the cost of the insurance against the potential benefits to determine if it’s worth it for your situation.

2. Limited Coverage: While flight insurance can provide coverage for unexpected events, there are some limitations to consider. For example, coverage may be limited to certain types of events, and there may be restrictions on when you can file a claim.

3. Redundant Coverage: If you already have travel insurance or other types of insurance that provide coverage for unexpected events, purchasing flight insurance may be redundant. Be sure to review your existing insurance policies before deciding to purchase flight insurance.

Conclusion

So, is flight insurance worth it with American Airlines? The answer depends on your individual needs and circumstances. If you’re traveling during a busy time of year, or if you’re concerned about unexpected events that may disrupt your trip, flight insurance can provide peace of mind and protection. However, if you already have coverage through other insurance policies, or if you’re on a tight budget, flight insurance may not be worth the added expense.

Ultimately, the decision to purchase flight insurance with American Airlines is a personal one. Be sure to carefully review the terms and conditions of any insurance policy before making a purchase, and consider all of your options to determine the best course of action for your travel plans.

Frequently Asked Questions

Here are some common questions about flight insurance for American Airlines:

What is flight insurance?

Flight insurance is a type of insurance that provides coverage for certain unforeseen events that may occur during air travel. These events may include trip cancellations, delays, lost or damaged luggage, and medical emergencies.

Flight insurance can be purchased either directly from an airline or from a third-party insurance provider. It is typically offered as an optional add-on to a flight ticket purchase.

What does American Airlines’ flight insurance cover?

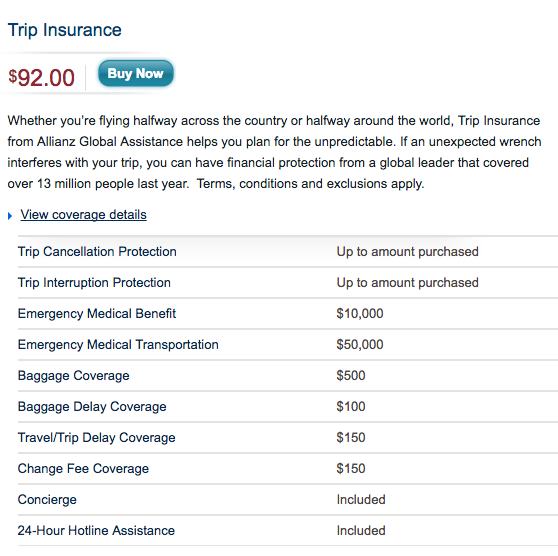

American Airlines’ flight insurance, which is provided by Allianz Global Assistance, offers coverage for trip cancellation, trip interruption, emergency medical and dental expenses, baggage protection, and travel accident coverage.

The exact coverage and benefits may vary depending on the type of plan selected and individual circumstances. It is important to carefully review the terms and conditions of any flight insurance policy before purchasing.

How much does American Airlines’ flight insurance cost?

The cost of American Airlines’ flight insurance varies depending on the type of plan selected and the cost of the flight. Prices typically range from a few dollars to a few hundred dollars.

It is important to carefully consider the cost of the insurance in relation to the potential benefits and risks associated with air travel, as well as any other insurance coverage that may already be in place.

When should I consider purchasing flight insurance for American Airlines?

Flight insurance may be worth considering for American Airlines or any other airline if you have a high-value trip that would be difficult to reschedule or if you are traveling to a destination with a higher risk of flight cancellations or other travel disruptions.

It is also worth considering if you are traveling with expensive or irreplaceable items, such as jewelry or electronics, that could be lost or damaged during air travel.

Is American Airlines’ flight insurance worth it?

Whether or not American Airlines’ flight insurance is worth it depends on individual circumstances and risk tolerance. Factors to consider include the cost of the insurance, the potential risks and benefits of air travel, and any other insurance coverage that may already be in place.

If you are unsure whether or not to purchase flight insurance, it may be helpful to consult with a trusted insurance professional or financial advisor to discuss your options and make an informed decision.

Should you buy travel insurance for your plane ticket?

In conclusion, whether or not flight insurance is worth it for American Airlines is ultimately up to the individual traveler. It’s important to consider factors such as the cost of the insurance, the likelihood of flight cancellations or delays, and any existing coverage already in place.

For some travelers, the added peace of mind and financial protection provided by flight insurance may be worth the investment. This is especially true for those with expensive or non-refundable tickets, or those traveling during peak seasons or inclement weather.

However, for others, the cost of flight insurance may outweigh the potential benefits, particularly if they already have coverage through credit cards or other insurance policies. Ultimately, it’s important for travelers to carefully weigh their options and make an informed decision based on their individual circumstances.