Delta Airlines is one of the largest airlines in the world, with a fleet of over 1,000 aircraft and serving over 325 destinations in 52 countries. With such a large presence in the global aviation industry, it’s no wonder that investors are curious about how Delta Airlines’ stock is performing.

In the past year, Delta Airlines’ stock has been through some ups and downs, reflecting the overall instability of the aviation industry during the COVID-19 pandemic. However, there are some positive signs that suggest Delta may be on the road to recovery. Let’s take a closer look at how Delta Airlines’ stock is doing and what factors are driving its performance.

Contents

- How is Delta Airlines Stock Doing?

- Frequently Asked Questions

- What factors impact Delta Airlines stock performance?

- What is the current stock price of Delta Airlines?

- Is Delta Airlines a good investment?

- What are analysts saying about Delta Airlines stock?

- How does Delta Airlines stock performance compare to its competitors?

- Delta is a good stock to own: Jim Lebenthal

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

How is Delta Airlines Stock Doing?

Delta Airlines is one of the biggest names in the airline industry and has been a favorite among investors for years. However, the COVID-19 pandemic has hit the travel industry hard, and Delta Airlines has not been immune to the impact. In this article, we will take a closer look at how Delta Airlines stock is performing and whether it is a good investment option.

Delta Airlines Stock Performance

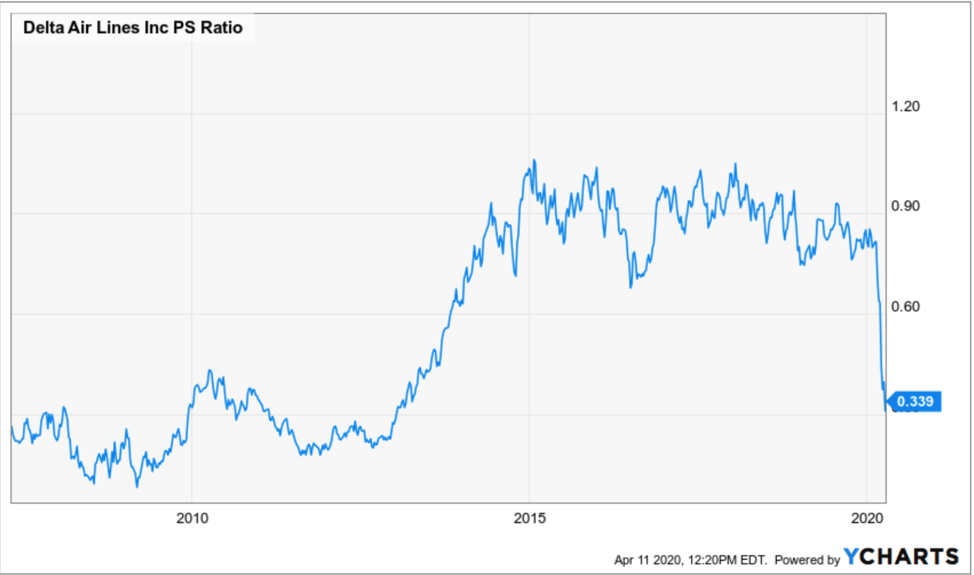

Delta Airlines stock has been on a rollercoaster ride since the pandemic hit. In February 2020, the stock was trading at around $60 per share, but it quickly dropped to below $20 per share by March 2020. Since then, the stock has shown some signs of recovery, but it is still far from its pre-pandemic levels.

As of August 2021, Delta Airlines stock is trading at around $40 per share, which is still significantly lower than its pre-pandemic levels. However, the stock has shown some positive momentum in recent months, and some analysts believe that it could continue to rise in the coming months.

Factors Affecting Delta Airlines Stock

Several factors are currently affecting Delta Airlines stock, both positively and negatively. One of the most significant factors is the ongoing COVID-19 pandemic, which has severely impacted the travel industry. With many countries still imposing travel restrictions and people being hesitant to travel, airlines like Delta are struggling to generate revenue.

However, there are also some positive factors that could affect Delta Airlines stock. For example, the US government has provided significant financial support to the airline industry, which has helped Delta stay afloat during these challenging times. Additionally, the rollout of vaccines across the world could lead to an increase in travel demand, which would be beneficial for Delta and other airlines.

Benefits of Investing in Delta Airlines Stock

Despite the challenges facing Delta Airlines, there are still some benefits to investing in the company’s stock. For one, Delta is one of the largest and most established airline companies in the world, which means that it has the resources and expertise to weather the current crisis.

Additionally, Delta has a strong track record of delivering value to its shareholders. Before the pandemic, the company consistently paid dividends and repurchased shares, which helped to boost shareholder returns. While Delta has suspended its dividend payments and share repurchases during the pandemic, it is likely to resume these activities once the situation improves.

Delta Airlines Stock vs. Competitors

Delta Airlines is not the only airline company struggling during the pandemic. Many other companies, including American Airlines and United Airlines, have also seen their stock prices plummet. However, Delta has managed to perform better than some of its competitors, such as Southwest Airlines.

One reason for this is that Delta has a more diversified business model than some of its competitors. The company has a strong presence in international markets, which has helped to offset some of the losses in the domestic market. Additionally, Delta has a robust cargo business, which has been in high demand during the pandemic.

Should You Invest in Delta Airlines Stock?

Whether or not you should invest in Delta Airlines stock depends on your investment goals and risk tolerance. While the stock has shown some signs of recovery, there is still significant uncertainty surrounding the travel industry’s future. Additionally, there are several other factors that could affect Delta’s stock price, such as fuel prices and labor costs.

If you are considering investing in Delta Airlines stock, it is essential to do your research and consult with a financial advisor. They can help you evaluate the risks and benefits of investing in the company and determine whether it is a suitable investment option for you.

Conclusion

In conclusion, Delta Airlines stock has been impacted by the COVID-19 pandemic, but it has shown some signs of recovery in recent months. While there are still significant challenges facing the travel industry, there are also some positive factors that could help Delta and other airlines bounce back in the coming months. If you are considering investing in Delta Airlines stock, it is essential to do your due diligence and evaluate the risks and benefits before making a decision.

Frequently Asked Questions

Here are some common questions related to Delta Airlines stock performance:

What factors impact Delta Airlines stock performance?

Delta Airlines stock performance is impacted by a number of factors, including the overall performance of the airline industry, the company’s financial performance, and global economic conditions. Other factors that can influence Delta’s stock price include changes in fuel prices, labor costs, and geopolitical events.

Investors should also pay attention to Delta’s financial reports and key performance indicators such as revenue, earnings per share, and operating margins to gain a better understanding of the company’s financial health.

What is the current stock price of Delta Airlines?

The current stock price of Delta Airlines can be found by checking financial news websites, stock market apps, or by contacting a stockbroker. Keep in mind that stock prices can fluctuate throughout the day due to various market conditions, so it’s important to stay informed and monitor the stock price regularly.

Investors may also want to track historical trends in Delta’s stock price to identify patterns and better predict future performance.

Is Delta Airlines a good investment?

Investing in Delta Airlines can be a good option for those who believe in the long-term growth potential of the airline industry. However, it’s important to conduct thorough research and analysis before making any investment decisions.

Factors to consider when evaluating Delta as an investment opportunity include the company’s financial health, competitive landscape, and overall market conditions. Investors should also assess their own risk tolerance and investment goals before making any decisions.

What are analysts saying about Delta Airlines stock?

Analysts who cover Delta Airlines typically provide periodic updates on the company’s performance and prospects. These updates may include recommendations on whether to buy, sell, or hold the stock, as well as price targets and earnings estimates.

Investors can stay informed on analyst opinions by reading financial news websites and analyst reports, or by following market analysts on social media platforms such as Twitter or LinkedIn.

How does Delta Airlines stock performance compare to its competitors?

Delta Airlines operates in a highly competitive industry, and its stock performance can be influenced by the performance of its competitors. Investors can compare Delta’s stock price to other airline companies, such as American Airlines, United Airlines, and Southwest Airlines, to gain a better understanding of how the company is performing relative to its peers.

It’s important to note that each airline company has its own unique strengths and weaknesses, and stock performance can be impacted by a variety of factors that may differ between companies.

Delta is a good stock to own: Jim Lebenthal

In conclusion, Delta Airlines stock has been performing well despite the challenges brought about by the pandemic. The company has managed to adapt to the changing landscape of the airline industry by implementing cost-saving measures and investing in new technologies to improve customer experience.

Investors have shown confidence in Delta Airlines, with the company’s stock price steadily increasing over the past year. This is a testament to the company’s ability to weather the storm and come out stronger on the other side.

As the world continues to recover from the pandemic, Delta Airlines is well-positioned to take advantage of the uptick in travel demand. With its strong brand reputation and commitment to customer satisfaction, Delta Airlines is a solid investment choice for those looking for a reliable and profitable stock option.