Have you ever considered investing in United Airlines? One of the factors that many investors look at when considering a stock is whether or not it pays dividends. In this article, we’ll take a closer look at United Airlines and whether or not it’s a dividend-paying stock. So, let’s dive in and explore!

Contents

- Does United Airlines Stock Pay Dividends?

- Frequently Asked Questions

- What is a dividend?

- How do dividends work?

- Is United Airlines stock a good investment?

- Does United Airlines pay dividends?

- What are some alternatives to investing in United Airlines stock?

- United Airlines stock surges on solid earnings beat

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Does United Airlines Stock Pay Dividends?

If you’re an investor looking for a reliable income stream, one of your first questions might be whether or not a company pays dividends. Dividends are regular payments made by a company to its shareholders, usually out of its profits. United Airlines is one of the largest airlines in the world, but does it pay dividends? In this article, we’ll explore the answer to that question and what it means for investors.

What Are Dividends?

Before we dive into whether United Airlines pays dividends, let’s take a closer look at what dividends are. Dividends are a way for companies to distribute their profits to shareholders. When a company earns money, it can choose to reinvest that money in the business or distribute it to shareholders in the form of a dividend. Dividends are usually paid in cash, but they can also be paid in the form of stock or other assets.

There are several benefits to investing in companies that pay dividends. First, dividends can provide a reliable income stream for investors, especially those who are retired or looking for passive income. Second, companies that pay dividends are often more stable and mature than companies that don’t. Finally, dividends can be a sign that a company is financially healthy and profitable.

Does United Airlines Pay Dividends?

Now let’s answer the question at hand: Does United Airlines pay dividends? Unfortunately, the answer is no. United Airlines does not currently pay dividends to its shareholders. This means that if you’re looking for a reliable income stream from your investments, United Airlines may not be the best choice for you.

However, it’s important to note that United Airlines is not alone in this regard. Many airlines, particularly those in the United States, do not pay dividends. This is because the airline industry is notoriously cyclical and volatile, with profits often being tied to factors outside of a company’s control, such as fuel prices and global events.

Why Doesn’t United Airlines Pay Dividends?

So why doesn’t United Airlines pay dividends? As we mentioned earlier, the airline industry is highly cyclical and volatile. Airlines often have to deal with unexpected events, such as natural disasters, terrorist attacks, and pandemics, that can have a significant impact on their profits. In addition, airlines are highly capital-intensive businesses, meaning that they require a lot of money to operate and grow. This can make it difficult for airlines to generate consistent profits and pay dividends to shareholders.

Another factor to consider is that United Airlines has historically been focused on reducing its debt and improving its financial position. The company has had a rocky financial history, with bankruptcy filings in both 2002 and 2010. Since then, United Airlines has worked to reduce its debt and improve its profitability, which has meant prioritizing reinvesting profits back into the business rather than paying dividends to shareholders.

Should You Invest in United Airlines?

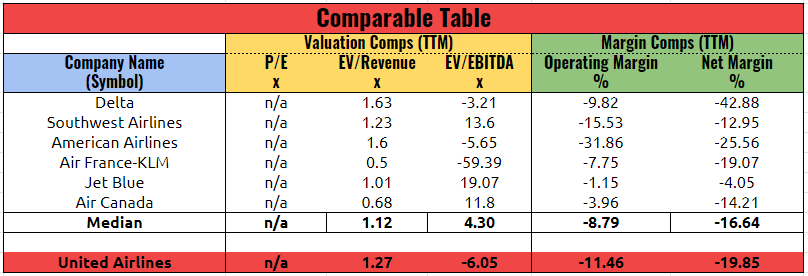

So, now that we know that United Airlines does not pay dividends, should you still consider investing in the company? The answer to that question depends on your investment goals and risk tolerance. If you’re looking for a reliable income stream from your investments, United Airlines may not be the best choice for you. However, if you’re interested in investing in the airline industry and believe that United Airlines has strong growth potential, it may be worth considering.

It’s important to remember that investing in individual stocks, including United Airlines, carries a significant amount of risk. Airlines are particularly vulnerable to economic downturns and unexpected events, as we’ve seen with the COVID-19 pandemic. If you do decide to invest in United Airlines or any other individual stock, it’s important to do your research and consider the potential risks and rewards.

The Bottom Line

In summary, United Airlines does not currently pay dividends to its shareholders. While this may be disappointing for investors looking for a reliable income stream, it’s important to remember that dividends are just one aspect of a company’s financial health. United Airlines has been focused on reducing its debt and improving its profitability, which may make it an attractive investment for those interested in the airline industry. However, investing in individual stocks carries risk, and investors should carefully consider their investment goals and risk tolerance before making any investment decisions.

Frequently Asked Questions

What is a dividend?

A dividend is a payment made by a corporation to its shareholders, usually in the form of cash or additional shares, as a distribution of profits.

Dividends are usually paid out quarterly or annually and are a way for companies to share their profits with their shareholders.

How do dividends work?

Dividends are typically paid out to shareholders on a per-share basis. For example, if a company pays a dividend of $0.50 per share and you own 100 shares, you would receive a total dividend payment of $50.

The amount of the dividend can vary from quarter to quarter and is usually determined by the company’s board of directors based on its financial performance and other factors.

Is United Airlines stock a good investment?

Whether or not United Airlines stock is a good investment depends on a variety of factors, including the current state of the airline industry, the company’s financial performance, and the overall economic climate.

Before investing in United Airlines or any other stock, it’s important to do your research and consult with a financial advisor to determine if it’s the right investment for you.

Does United Airlines pay dividends?

No, United Airlines does not currently pay dividends to its shareholders. The company has not paid a dividend since 2001.

United Airlines has instead chosen to reinvest its profits back into the business to fund growth and expansion.

What are some alternatives to investing in United Airlines stock?

If you’re looking for alternatives to investing in United Airlines stock, there are several options available. You could consider investing in other airline stocks, such as Delta or American Airlines, or in the broader transportation industry.

You could also consider investing in exchange-traded funds (ETFs) that track the airline industry or the broader stock market, or in other types of investments, such as real estate or bonds.

United Airlines stock surges on solid earnings beat

In conclusion, United Airlines stock does not currently pay dividends to its shareholders. While this may be a disappointment to some investors who rely on dividends for income, it is important to consider other factors such as the company’s financial health and growth potential.

United Airlines has faced significant challenges in the past year due to the COVID-19 pandemic, resulting in decreased revenue and profits. However, the company has been taking steps to adapt and recover, including cost-cutting measures and a focus on expanding its cargo business.

Investors should also consider the potential for future growth in the airline industry as travel restrictions are lifted and demand for air travel increases. While United Airlines stock may not currently offer dividends, it may still be a worthwhile investment for those who believe in the company’s long-term prospects.