Delta Airlines is one of the major players in the aviation industry, providing air travel services to millions of passengers worldwide. As a publicly-traded company, many investors are curious to know whether Delta Airlines pays dividends to its shareholders.

In this article, we will explore the topic of Delta Airlines and dividends. We will discuss what dividends are, how they work, and whether or not Delta Airlines pays dividends to its investors. So, buckle up and get ready to learn more about one of the leading airlines in the world.

Contents

- Does Delta Airlines Pay Dividends?

- Frequently Asked Questions

- What is a dividend?

- How can I find out if Delta Airlines pays dividends?

- What factors can influence a company’s decision to pay dividends?

- What are the advantages and disadvantages of investing in dividend-paying stocks?

- What are some other ways that companies can reward their shareholders?

- How often does Delta pay dividends?

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Does Delta Airlines Pay Dividends?

Delta Airlines is one of the leading airlines in the world, providing services to over 300 destinations in more than 50 countries. Delta has been a major player in the airline industry for decades, and has a loyal customer base that trusts the airline to provide them with safe and comfortable flights. One of the questions that investors often ask about Delta Airlines is whether or not the company pays dividends.

Understanding Dividends

Before we dive into whether or not Delta Airlines pays dividends, it’s important to understand what dividends are and how they work. Dividends are payments that companies make to their shareholders as a way to distribute profits. Companies that are profitable and have excess cash on hand can choose to pay out dividends to their shareholders, as a way to reward them for investing in the company.

When a company pays dividends, it typically does so on a regular basis, such as quarterly or annually. The amount of the dividend is usually expressed as a percentage of the company’s stock price, and can vary depending on a number of factors, including the company’s profitability, cash flow, and growth prospects.

Does Delta Airlines Pay Dividends?

Unfortunately for investors looking for a steady stream of income, Delta Airlines does not currently pay dividends. Instead, the company has chosen to reinvest its profits back into the business, with a focus on expanding its fleet, improving its operations, and enhancing the customer experience.

While this may be disappointing news for investors who are looking for dividend income, it’s important to remember that there are other ways to make money in the stock market. For example, investors can buy shares of a company with the expectation that the stock price will increase over time, allowing them to sell their shares at a profit.

Benefits of Investing in Delta Airlines

While Delta Airlines may not pay dividends, there are still a number of reasons why investors may want to consider investing in the company’s stock. For starters, Delta is one of the largest airlines in the world, with a strong brand and a reputation for providing high-quality service to its customers.

In addition, the airline industry is known for being cyclical, with periods of growth and contraction. Delta has a strong track record of weathering economic downturns and coming out on top, thanks to its focus on operational efficiency and cost control.

Finally, Delta has a number of growth opportunities on the horizon, including expanding its international routes and investing in new technologies to improve the customer experience. For investors with a long-term perspective, these growth prospects could translate into significant gains in the stock price over time.

Delta Airlines vs. Other Airlines

When considering whether to invest in Delta Airlines, it’s important to compare the company to its competitors in the airline industry. One of Delta’s biggest competitors is Southwest Airlines, which has a reputation for low fares and a unique corporate culture.

While Southwest may appeal to budget-conscious travelers, Delta has a number of advantages over its rival, including a larger route network, a more diverse customer base, and a broader range of services. In addition, Delta has a strong balance sheet and a solid financial position, which has allowed the company to weather economic downturns better than many of its competitors.

Conclusion

In conclusion, Delta Airlines does not currently pay dividends to its shareholders. However, investors should not overlook the many other benefits of investing in the company, including its strong brand, operational efficiency, and growth prospects. By carefully considering these factors, investors can make an informed decision about whether or not Delta Airlines is a good investment for their portfolio.

Frequently Asked Questions

What is a dividend?

A dividend is a payment made by a corporation to its shareholders, usually as a distribution of profits. Dividends are typically paid out in cash or stock, and are often seen as a way for companies to share their financial success with their investors.

Not all companies pay dividends, and those that do may not pay them consistently or at all times. The decision to pay dividends is made by a company’s board of directors, and may be influenced by a variety of factors, including the company’s financial performance, cash reserves, and growth plans.

How can I find out if Delta Airlines pays dividends?

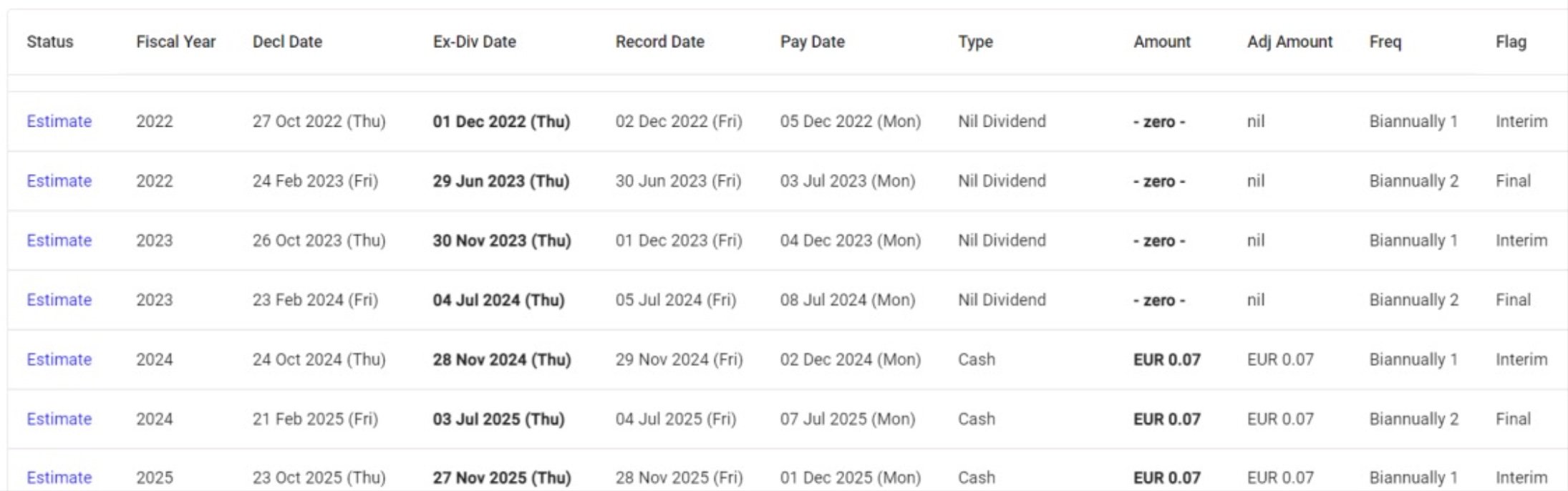

The best way to find out if Delta Airlines pays dividends is to check its investor relations website or the stock exchange where its shares are listed. These sources will typically provide information on the company’s dividend history, including how much it has paid out in the past and when it made those payments.

It’s important to note that a company’s dividend policy can change over time, so even if Delta Airlines has paid dividends in the past, it may not continue to do so in the future.

What factors can influence a company’s decision to pay dividends?

There are several factors that can influence a company’s decision to pay dividends, including its financial performance, cash reserves, growth plans, and investor expectations. A company that is profitable and has a healthy balance sheet may be more likely to pay dividends, as it has the financial resources to do so.

On the other hand, a company that is experiencing financial difficulties or is focused on investing in growth opportunities may choose to conserve its cash reserves and not pay dividends. Similarly, if investors are more interested in capital appreciation than income, a company may choose to reinvest its profits in the business rather than pay dividends.

What are the advantages and disadvantages of investing in dividend-paying stocks?

One advantage of investing in dividend-paying stocks is that they can provide a steady stream of income, which can be particularly appealing to investors who are retired or looking for income-generating investments. Dividend-paying stocks can also be less volatile than non-dividend-paying stocks, as they tend to be associated with more established, mature companies.

However, there are also some disadvantages to investing in dividend-paying stocks. For example, companies that pay dividends may be less likely to reinvest profits in the business, which could limit their growth potential. Additionally, the value of a company’s stock can be negatively impacted if it cuts or suspends its dividend payments.

In addition to paying dividends, companies can reward their shareholders in a variety of other ways. For example, they may choose to repurchase shares of their own stock, which can increase the value of the remaining shares. Companies may also offer special dividends or one-time payouts to shareholders.

Another way that companies can reward their shareholders is by increasing the value of their stock through strong financial performance or growth prospects. This can result in capital appreciation for shareholders, even if the company does not pay regular dividends.

How often does Delta pay dividends?

In conclusion, Delta Airlines does not currently pay dividends to its shareholders. While this may be disappointing news for some investors, it is important to understand that Delta has other ways of rewarding shareholders, such as share buybacks and reinvesting profits into the growth of the company.

It is also important to note that Delta has remained financially stable despite the challenges faced by the airline industry, thanks to its strong management team and strategic investments. As the world recovers from the COVID-19 pandemic and air travel continues to increase, Delta is well positioned to continue providing value to its investors.

Ultimately, while dividends may be a desirable form of investment income, it is important to consider the overall financial health and potential for growth of a company like Delta Airlines before making any investment decisions.