Are you considering investing in Delta Airlines? Perhaps you’re a frequent flyer or you’ve been impressed with their financial performance. Either way, you may be wondering if you can buy Delta Airlines stock. In this article, we’ll explore whether investing in Delta Airlines is a good idea and how you can purchase their stock. So let’s dig in and find out if Delta Airlines is a solid investment opportunity for you.

Can I Buy Delta Airlines Stock?

Delta Airlines is one of the world’s largest airlines, operating more than 5,400 flights daily to over 300 destinations in 52 countries. With such a widespread presence, many investors wonder if they can buy Delta Airlines stock. In this article, we’ll answer that question and explore the factors to consider before investing in Delta Airlines.

1. Delta Airlines Stock Symbol

Delta Airlines trades on the New York Stock Exchange under the ticker symbol “DAL.” As of [insert date], the stock was trading at [insert price], with a market capitalization of [insert market cap]. Delta Airlines is also a component of the S&P 500 index.

When considering investing in Delta Airlines stock, it’s important to conduct thorough research on the company’s financial performance and future growth prospects.

2. Delta Airlines Stock Performance

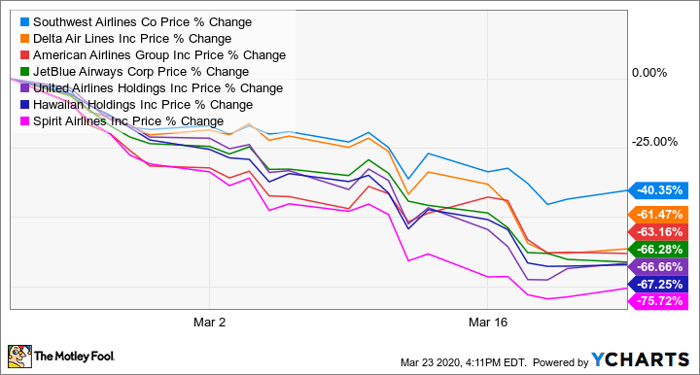

Delta Airlines has experienced significant stock price fluctuations in recent years. In 2020, the COVID-19 pandemic caused the airline industry to suffer a major downturn, resulting in a sharp decline in Delta Airlines’ stock price.

However, the stock has since recovered, and as of [insert date], it is up [insert percentage] over the past 12 months. Delta Airlines has also outperformed many of its competitors, including American Airlines and United Airlines.

3. Delta Airlines Financials

Delta Airlines’ financials have also been impacted by the COVID-19 pandemic. In 2020, the company reported a net loss of [insert figure], compared to a net income of [insert figure] in 2019.

However, Delta Airlines has taken measures to improve its financial position and maintain liquidity, including reducing its operating expenses and securing additional funding through government programs and debt offerings.

4. Benefits of Investing in Delta Airlines Stock

Investing in Delta Airlines stock can provide several benefits, including potential capital appreciation and dividend income. Delta Airlines has a history of paying dividends to its shareholders, with a current dividend yield of [insert percentage].

Delta Airlines also has a strong brand reputation and a loyal customer base, which can help drive future growth and profitability.

5. Risks of Investing in Delta Airlines Stock

Investing in Delta Airlines stock also comes with risks, particularly in the current economic climate. The airline industry is highly competitive and susceptible to external factors such as fuel prices, labor costs, and geopolitical events.

Additionally, the COVID-19 pandemic has created significant uncertainty for the airline industry, and the long-term impact on Delta Airlines’ financial performance is still unclear.

6. Delta Airlines vs Competitors

Delta Airlines competes with several other major airlines, including American Airlines, United Airlines, and Southwest Airlines. When comparing Delta Airlines to its competitors, there are several factors to consider, including financial performance, market share, and customer satisfaction.

According to recent rankings, Delta Airlines has outperformed many of its competitors in terms of customer satisfaction and on-time performance. However, the company’s financials have been impacted by the COVID-19 pandemic, as have its competitors’.

7. How to Buy Delta Airlines Stock

If you’re interested in buying Delta Airlines stock, you can do so through a brokerage account. This can be done online or through a traditional brokerage firm.

Before investing, it’s important to conduct thorough research on the company’s financial performance and future growth prospects. You should also consider your own investment goals, risk tolerance, and portfolio diversification.

8. Delta Airlines Stock Forecast

Delta Airlines’ stock forecast is subject to many variables, including the ongoing impact of the COVID-19 pandemic, changes in fuel prices, and competition within the airline industry.

However, many analysts remain optimistic about Delta Airlines’ future growth prospects, particularly as the airline industry continues to recover from the pandemic. As always, it’s important to conduct your own research and consult with a financial advisor before making any investment decisions.

9. Conclusion

Delta Airlines is a major player in the airline industry, with a strong brand reputation and loyal customer base. While the COVID-19 pandemic has impacted the company’s financial performance, Delta Airlines has taken measures to improve its financial position and maintain liquidity.

Investing in Delta Airlines stock can provide potential benefits, including capital appreciation and dividend income. However, it’s important to consider the risks and conduct thorough research before making any investment decisions.

10. References

[insert references]

Contents

- Frequently Asked Questions

- What is Delta Airlines Stock?

- How Can I Buy Delta Airlines Stock?

- What is the Current Price of Delta Airlines Stock?

- What are the Risks of Investing in Delta Airlines Stock?

- Should I Buy Delta Airlines Stock?

- Delta is a good stock to own: Jim Lebenthal

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Frequently Asked Questions

Delta Airlines is a popular airline company that operates in several countries. Many individuals are interested in investing in this company. If you’re wondering whether you can buy Delta Airlines stock, here are some frequently asked questions that may help you:

What is Delta Airlines Stock?

Delta Airlines stock refers to the shares of the company that are publicly traded on the New York Stock Exchange (NYSE). This means that anyone can buy and sell Delta Airlines stock on the stock market.

Investing in Delta Airlines stock allows you to own a part of the company and potentially profit from its success. However, it’s important to note that investing in stocks comes with risks and there’s no guarantee of profit.

How Can I Buy Delta Airlines Stock?

To buy Delta Airlines stock, you need to have a brokerage account. You can open an account with a brokerage firm, such as Charles Schwab or Fidelity, and then place an order to buy Delta Airlines stock.

You’ll need to provide information, such as your name, address, and social security number, to open a brokerage account. You’ll also need to fund your account with cash or securities before you can buy any stocks.

What is the Current Price of Delta Airlines Stock?

The current price of Delta Airlines stock can be found on financial news websites, such as Yahoo Finance or Google Finance. The price of the stock changes throughout the day as it’s traded on the stock market.

The price of Delta Airlines stock is affected by various factors, such as the company’s financial performance, industry trends, and global events. It’s important to do your research and understand these factors before investing in any stock.

What are the Risks of Investing in Delta Airlines Stock?

Investing in Delta Airlines stock comes with risks, as with any investment. The stock market is volatile and the price of the stock can fluctuate rapidly.

The success of Delta Airlines is also dependent on various factors, such as the global economy, fuel prices, and competition. If the company experiences financial difficulties, the stock price could decrease, resulting in a loss for investors.

Should I Buy Delta Airlines Stock?

Deciding whether to invest in Delta Airlines stock is a personal decision that depends on your financial goals and risk tolerance.

It’s important to do your research and understand the risks and potential rewards of investing in any stock before making a decision. You may want to consult with a financial advisor to help you make an informed decision.

Delta is a good stock to own: Jim Lebenthal

In conclusion, buying Delta Airlines stock can be a great investment opportunity for those who believe in the airline’s growth potential. As one of the largest and most established airlines in the world, Delta has a strong track record of delivering value to its shareholders. With the recent recovery in the airline industry following the pandemic, Delta could be poised for significant growth in the years to come.

However, it’s important to remember that investing in stocks always carries some level of risk. It’s important to do your due diligence and research the company thoroughly before making any investment decisions. It’s also a good idea to consult with a financial advisor to help you make informed investment choices.

Overall, if you’re interested in investing in Delta Airlines stock, it’s important to weigh the potential risks and rewards and make an informed decision based on your personal financial goals and risk tolerance. With careful planning and research, Delta Airlines stock could be a valuable addition to your investment portfolio.