Delta Airlines is one of the largest airlines in the world, serving millions of passengers every year and operating in over 300 destinations. The airline has been in business for over 90 years and has established a reputation for safety, reliability, and excellent customer service.

If you’re considering investing in the stock market, Delta Airlines stock is a great option to consider. Not only does the airline have a strong track record of profitability, but it also has a significant presence in the industry and a loyal customer base. In this article, we’ll explore why buying Delta Airlines stock could be a smart move for your investment portfolio.

Contents

- Why Buy Delta Airlines Stock?

- Frequently Asked Questions

- What are the reasons to buy Delta Airlines Stock?

- What is the current financial position of Delta Airlines?

- What are the risks associated with investing in Delta Airlines?

- What is Delta Airlines’ dividend policy?

- What is the long-term outlook for Delta Airlines?

- Delta is a good stock to own: Jim Lebenthal

- How Many Bags American Airlines?

- How To Fly Standby On American Airlines?

- Why Does My American Airlines Ticket Say Pending?

Why Buy Delta Airlines Stock?

Delta Airlines is one of the largest airline companies in the world, with a strong reputation for reliability and customer service. If you are considering investing in the stock market, Delta Airlines stock is a great option to consider. In this article, we will explore the reasons why buying Delta Airlines stock is a smart investment decision.

1. Strong Financial Performance

Delta Airlines has a solid track record of strong financial performance. In 2020, despite the challenges posed by the COVID-19 pandemic, Delta Airlines generated $17.1 billion in revenue and maintained strong liquidity with $16.7 billion in cash and short-term investments. Despite a significant drop in demand for air travel due to the pandemic, Delta Airlines managed to keep its operating expenses under control and reduced its net debt by $18 billion in 2020.

In addition, Delta Airlines has a strong balance sheet, with a debt-to-capital ratio of 52%, which is below the industry average of 62%. This means that Delta Airlines has a lower risk of defaulting on its debt obligations and has more financial flexibility to invest in growth opportunities.

Delta Airlines is one of the top three airlines in the United States, with a leading market share of 17.7% as of 2020. In addition, Delta Airlines has a strong presence in international markets, with a network of over 300 destinations in more than 50 countries.

This market share gives Delta Airlines a competitive advantage in negotiating pricing and securing contracts with suppliers, which can help to drive profitability. Delta Airlines also has a loyal customer base, which has helped the company to maintain its market share and reputation for quality service.

3. Strong Brand and Reputation

Delta Airlines has a strong brand and reputation for reliability and customer service. The company has won numerous awards for its customer service and has consistently ranked at the top of airline customer satisfaction surveys.

This strong brand and reputation can help to drive customer loyalty and attract new customers, which can help to drive revenue growth. In addition, a strong brand and reputation can help to mitigate the impact of negative events, such as flight cancellations or delays.

4. Focus on Innovation and Technology

Delta Airlines has a strong focus on innovation and technology, which has helped the company to improve its operations and customer experience. For example, Delta Airlines has invested in biometric technology, such as facial recognition, to streamline the check-in process and reduce wait times.

In addition, Delta Airlines has invested in new aircraft and has a modern fleet that is more fuel-efficient and environmentally friendly. These investments in innovation and technology can help to drive operational efficiency and reduce costs, which can help to drive profitability.

5. Strong Management Team

Delta Airlines has a strong management team with a deep understanding of the airline industry. The company’s CEO, Ed Bastian, has been with Delta Airlines for over 20 years and has played a key role in the company’s success.

The management team’s focus on operational efficiency and customer service has helped to drive Delta Airlines’ strong financial performance and reputation. In addition, the management team has demonstrated a commitment to shareholder value, with a track record of returning capital to shareholders through dividends and share buybacks.

6. Dividend Yield

Delta Airlines offers a dividend yield of approximately 1.6%, which is higher than the average dividend yield of the S&P 500. This dividend yield provides investors with a steady stream of income and can help to mitigate the impact of market volatility.

In addition, Delta Airlines has a track record of increasing its dividend payout over time, which can help to drive long-term returns for investors.

7. Attractive Valuation

Delta Airlines is currently trading at an attractive valuation, with a price-to-earnings ratio of 5.3 as of August 2021. This valuation is lower than the industry average and the company’s historical average, which suggests that the stock may be undervalued.

Investors who buy Delta Airlines stock at a lower valuation may benefit from potential capital appreciation as the stock price increases over time.

8. Risks and Challenges

While Delta Airlines has many strengths as an investment opportunity, there are also risks and challenges to consider. For example, the airline industry is highly competitive and subject to volatility, which can impact Delta Airlines’ financial performance.

In addition, the COVID-19 pandemic has had a significant impact on the airline industry, and it is uncertain how long it will take for demand for air travel to return to pre-pandemic levels.

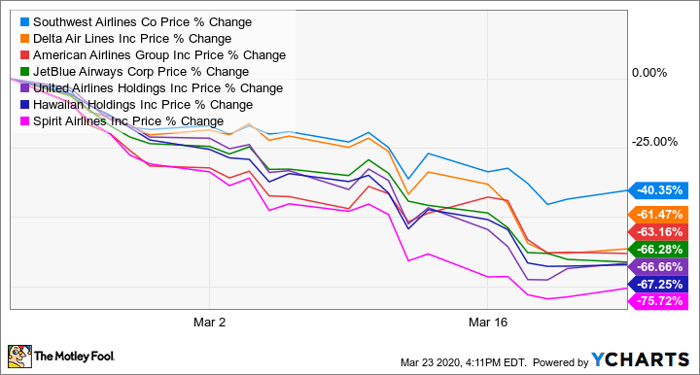

9. Delta Airlines vs Competitors

When compared to its competitors, Delta Airlines has many strengths that make it an attractive investment opportunity. For example, Delta Airlines has a leading market share, a strong balance sheet, and a focus on innovation and technology.

Compared to American Airlines and United Airlines, Delta Airlines has a lower debt-to-capital ratio and a higher dividend yield. This suggests that Delta Airlines may be a better investment opportunity for investors who are looking for a more stable, long-term investment.

10. Conclusion

In conclusion, buying Delta Airlines stock is a smart investment decision for investors who are looking for a stable, long-term investment opportunity. Delta Airlines has a solid track record of strong financial performance, a leading market share, a strong brand and reputation, a focus on innovation and technology, and a strong management team.

While there are risks and challenges to consider, Delta Airlines’ attractive valuation and dividend yield make it an attractive investment opportunity. By investing in Delta Airlines stock, investors can benefit from potential capital appreciation and a steady stream of income through dividend payouts.

Frequently Asked Questions

What are the reasons to buy Delta Airlines Stock?

Delta Airlines is one of the world’s largest airlines, with a strong reputation and a solid financial position. The company has a well-diversified business model, with a focus on both domestic and international markets. Delta Airlines has managed to maintain a strong competitive position in the aviation industry, with a commitment to innovation and customer service. Additionally, Delta Airlines has a strong track record of delivering value to shareholders, with consistent dividend payments and a history of share buybacks.

In recent years, Delta Airlines has also been investing heavily in technology and innovation, with a focus on improving the customer experience and reducing costs. The company has been working on initiatives such as biometric check-ins and facial recognition technology, which have the potential to revolutionize the aviation industry.

What is the current financial position of Delta Airlines?

Delta Airlines has a solid financial position, with a strong balance sheet and a history of steady revenue growth. The company has a market capitalization of over $30 billion, and has consistently delivered positive earnings. In 2019, Delta Airlines generated over $47 billion in revenue, with a net income of over $4.7 billion.

Delta Airlines also has a strong liquidity position, with over $6 billion in cash and cash equivalents. The company has a low debt-to-equity ratio of just 0.92, indicating a conservative approach to financing.

What are the risks associated with investing in Delta Airlines?

As with any investment, there are risks associated with investing in Delta Airlines. One of the biggest risks is the potential for a downturn in the aviation industry, which could impact Delta Airlines’ revenue and earnings. Additionally, Delta Airlines is exposed to risks such as fuel price fluctuations, geopolitical instability, and natural disasters, which could impact the company’s financial performance.

Investors should also be aware of potential regulatory risks, as the aviation industry is subject to a wide range of regulations and government oversight. Finally, investors should consider the potential impact of competition, as Delta Airlines faces intense competition from both traditional and low-cost carriers.

What is Delta Airlines’ dividend policy?

Delta Airlines has a strong track record of delivering value to shareholders through consistent dividend payments and share buybacks. In 2019, Delta Airlines paid out over $1.3 billion in dividends, with a dividend yield of approximately 2.9%. The company has also been actively buying back shares, with over $2.5 billion in share repurchases in 2019 alone.

Delta Airlines has stated that it intends to maintain its dividend policy, with a commitment to returning value to shareholders. However, investors should be aware that dividends are subject to change, and that there is no guarantee that Delta Airlines will continue to pay dividends at the current rate.

What is the long-term outlook for Delta Airlines?

Delta Airlines has a strong long-term outlook, with a well-diversified business model and a focus on innovation and customer service. The company has a strong financial position and a commitment to returning value to shareholders. Additionally, Delta Airlines has a strong track record of adapting to changes in the aviation industry, and has been investing heavily in technology and innovation to improve the customer experience and reduce costs.

The aviation industry is expected to continue to grow in the coming years, driven by increasing demand for air travel and a growing global economy. As one of the world’s largest airlines, Delta Airlines is well-positioned to benefit from this growth, with a strong competitive position and a focus on delivering value to customers and shareholders alike.

Delta is a good stock to own: Jim Lebenthal

In conclusion, there are several reasons why buying Delta Airlines stock is a wise investment decision. Firstly, the airline has a strong financial position and has consistently delivered solid financial results over the years. This means that investors can expect stable returns on their investment.

Secondly, Delta has a strong brand reputation and a loyal customer base. This ensures that the airline is well-positioned to weather any challenges that may arise in the industry. Additionally, the airline has a strong focus on customer service and has invested heavily in improving its customer experience.

Finally, Delta has a strong leadership team in place, with a track record of making strategic decisions that have led to the airline’s success. With a focus on innovation and technology, Delta is well-positioned to continue to grow and succeed in the future.

Overall, investing in Delta Airlines stock is a smart decision for investors looking for a stable, reliable investment with long-term growth potential. With a strong financial position, a loyal customer base, and a focus on innovation, Delta is poised for continued success in the coming years.